***Friday Highlights

Listen to some recorded webinars to brush up on your Reverse Mortgage skills! These are links to recordings. If you cannot open the links in Internet Explorer try Chrome. ***Intro

***Friday Highlights

Listen to some recorded webinars to brush up on your Reverse Mortgage skills! These are links to recordings. If you cannot open the links in Internet Explorer try Chrome. ***Knowing

Welcome to HomeSafe® – Loan Origination

The HomeSafe® is the proprietary retirement financing tool of Finance of America Reverse. In this series of Loan Origination you will learn about the products, guidelines, requirements and how Financial

Financial Assesment – Willingness and Capacity, CRMP approved

Looking at a RM borrower qualification through the Financial Assessment lens. A review of the different credit scenarios of the Reverse Mortgage Borrower. Includes willingness and capacity, liabilities, property charges,

Reverse Mortgage 101

Whether you are new to the industry or want to brush up on your RM skills this call is for you. Trainer: Jim McMinn, FAR - Lead Sales Trainer To

Sequence of Returns Risk with Home Equity, for CPA’s

Free Webinar: An impactful study published in the Journal of Financial Planning has led to a new sequence of returns withdrawal strategy that will help preserve and grow your client’s

***Friday Highlights

Listen to some recorded webinars to brush up on your Reverse Mortgage skills! These are links to recordings. If you cannot open the links in Internet Explorer try Chrome. ***HomeSafe

ReverseVision Overview

Join us as we discuss and demonstrate how to use ReverseVision to print out both proposals and application. This class will include Financial Assessment Trainer: Jim McMinn, FAR, Lead –

Grass Roots Marketing

This course is designed to help Reverse Mortgage Professionals market to Business to Business, Business to Consumer and Business to Communities. Trainer: Jim McMinn, FAR - Lead Sales Trainer To

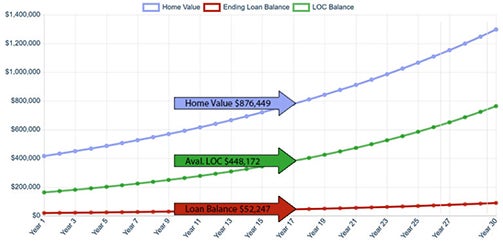

Reverse Illustrator

Our powerful Reverse Illustrator will help drive sales to your planning based prospects as it graphically displays the features and flexibility of the reverse mortgage over a 30 year term.

Reverse for Home Purchase

Home equity is a large part of a client's overall net worth. Advisors can add value by guiding clients in a way that benefits their overall retirement plan. In this