FAR Offices Closed

FAR offices are closed today. Go get some Black Friday shopping in!!

Seasoning and Occupancy

You will lean the difference between Seasoning and Occupancy and what documentation can be used for verification Trainer: Jessica Rankins, FAR's AVP Training and Process Management To register for the

HECM Non-Borrowing Spouse

How are Non-Borrowing Spouses and Non-Borrowing Owners treated? What can and can't they do? Trainer: Sue Haviland - National Sales Trainer and Barb Cripple - Retail Sales Training Manager To

In-House Processing

FAR is pleased to offer our valued partners the option of In-House Processing. We are offering this service (for a nominal fee) as an additional tool to enable our partners

HomeSafe Overview

FAR's proprietary product offers the perfect niche for home values greater than HUD's HECM limits. Trainer: Sue Haviland, National Wholesale Trainer and Barb Cripple, Retail Sales Training Manager To register

Preparing for the Rebound, CFP CE

Free Webinar: An impactful study published in the Journal of Financial Planning has led to a new sequence of returns withdrawal strategy that will help preserve and grow your client’s

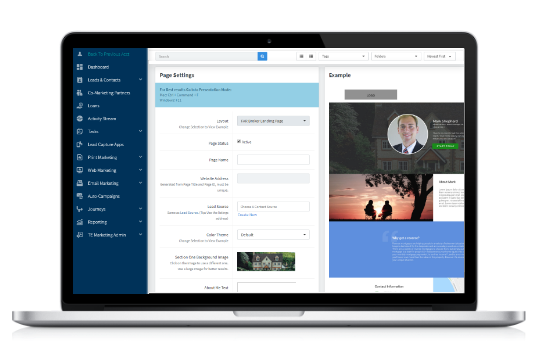

Total Expert Workshop

Total Expert Workshop - 30 minute training on how to use Total Expert Trainer: Ryan Schmidt, Brett Kelly and Meg Murray - Wholesale Marketing Team To register for the class

***Friday Highlights

This is a recording from a previous call that you can view at your leisure. ***HECM to HECM Refinance Passcode: &Ha8o38S Link works best in Chrome and best to

L&D Annual Conference

Learning and Development will be meeting from the 6th to the 8th to discuss 2022.

L&D Annual Conference

Learning and Development will be meeting from the 6th to the 8th to discuss 2022.

Reverse Illustrator and Financial Planning

With rapidly appreciating home values, more and more Financial Advisors and their clients are taking a fresh look at Reverse Mortgages. Now with our powerful Illustrator tool, you will be

L&D Annual Conference

Learning and Development will be meeting from the 6th to the 8th to discuss 2022.