What Advisors Should Know When a Client Downsizes or Rightsizes Their Home

Home equity is a large part of a client's overall net worth. Advisors can add value by guiding clients in a way that benefits their overall retirement plan. In this 1 hour webinar you will learn: • How a move can be an opportunity to improve retirement plan outcomes • The Downsize and Rightsize Strategy

***Friday Highlights

Listen to some recorded webinars to brush up on your Reverse Mortgage skills! These are links to recordings. If you cannot open the links in Internet Explorer try Chrome. ***New York HECM Loans Password: 7n$17jct

**Monday Highlights

Listen to some recorded webinars to brush up on your Reverse Mortgage skills! These are links to recordings. If you cannot open the links in Internet Explorer try Chrome. ***What Sales Should Know About Servicing Password: 0h!?0=o! In order to receive CRMP credit you must attend a live class or take the course on

HECM and HomeSafe® Practical Product Uses

Explore each product, when a borrower might choose one product over another, and their different characteristics. Trainer: Jim McMinn, Lead Sales Training Manager and Karen Resch, Sales Trainer To register for the class please click here. Remember the class will be held at 2 pm, EDT (11 am, PST) HOW to Join the Webinar REGISTRATION:

**Monday Highlights

Listen to some recorded webinars to brush up on your Reverse Mortgage skills! These are links to recordings. If you cannot open the links in Internet Explorer try Chrome. ***ReverseVision Overview Password: 3V$5$*#s

Grass Roots Marketing: Phase 2

This course is designed to help Reverse Mortgage Professionals market to Business to Business, Business to Consumer and Business to Communities with a twist of doing this virtually. Trainer: Lorraine Geraci, VP of Learning and Development To register for the class please click here. Remember the class will be held at 1:30 pm, EDT (10:30

Funding Long Term Care and Preserving Income with Home Equity

Learn how millions of Americans will unintentionally spend 100% of their home equity on care, new strategies for funding Long-Term Care and how a reverse mortgage can help clients age in place and prevent portfolio liquidation. Trainer: Phil Walker, FAR - Retirement Strategies To register for the class please click here. Remember the class will be

***Friday Highlights

Listen to some recorded webinars to brush up on your Reverse Mortgage skills! These are links to recordings. If you cannot open the links in Internet Explorer try Chrome. ***Line of Credit and how it is Determined Password: 1F=3x28v

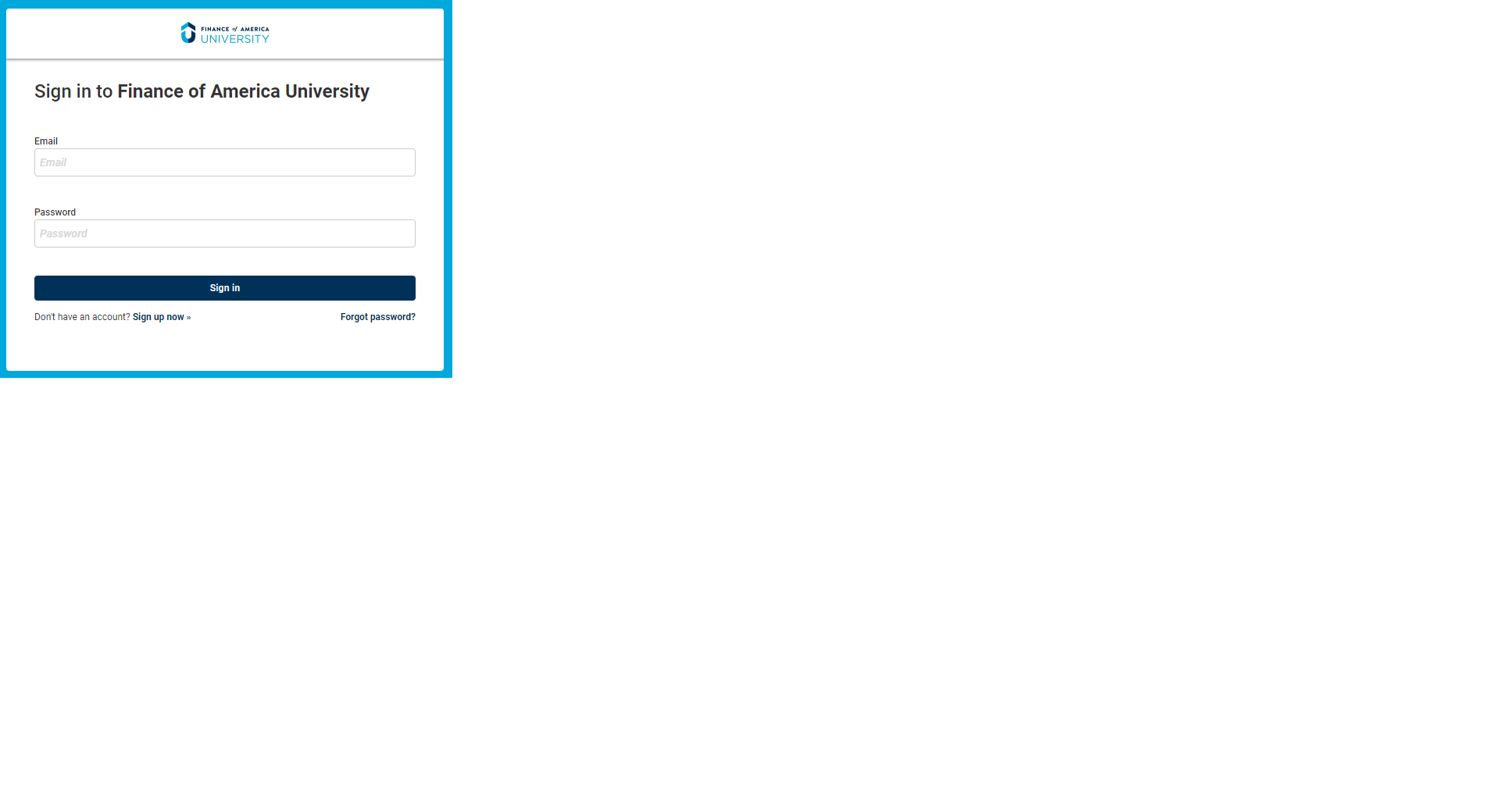

Intro to FAU (Finance of America University)

FAR's Learning System Administrator will introduce you to Finance of America University (FAU), your go-to destination for reverse mortgage training. We'll cover all the basics like course registration, navigating the course catalog, completing learning pathways, and answering frequently asked questions. Trainer: Meagan Windler, Learning Systems Administrator and Instructional Design To register for the class please

***Recording

***HECM and HomeSafe® Practical Product Use to Meet Borrower's Financial Goals Password: 9j@00970

Managing Sequence of Returns Risk with Home Equity, CA CPA Credits

Free Webinar: An impactful study published in the Journal of Financial Planning has led to a new sequence of returns withdrawal strategy that will help preserve and grow your client’s retirement assets…even if they are taking systematic income distributions. Offering 1 CE Credit for CPA's only Duration: 1 hour Trainer: Phil Walker, FAR - Retirement Strategies

***Friday Highlight

Listen to some recorded webinars to brush up on your Reverse Mortgage skills! These are links to recordings. If you cannot open the links in Internet Explorer try Chrome. ***HomeSafe Overview Password: 8A^2?M5?