Total Expert Workshop

Total Expert Workshop - 30 minute training on how to use Total Expert Trainer: Ryan Schmidt, Brett Kelly and Meg Murray - Wholesale Marketing Team To register for the class

***Friday Highlights

This is a recording from a previous call that you can view at your leisure. ***Reverse Facts Passcode: fCfB#4es Link works best in Chrome and best to manually input

Funds to Close

If you have to bring funds to closing what are acceptable funds? Trainer: Jessica Rankins, FAR's AVP Training and Process Management To register for the class please click here. Remember

Ask the Trainer!

The trainers will go over any product related questions sent ahead of time. When registering you will be prompted to ask your questions. We will not be able to go

Financial Assessment Tips

Looking at a RM borrower qualification through the Financial Assessment lens. A review of the different credit scenarios of the Reverse Mortgage Borrower. Includes willingness and capacity, liabilities, property charges,

What Advisors Should Know When Their Client Wants to Rightsize

Home equity is a large part of a client's overall net worth. Advisors can add value by guiding clients in a way that benefits their overall retirement plan. In this

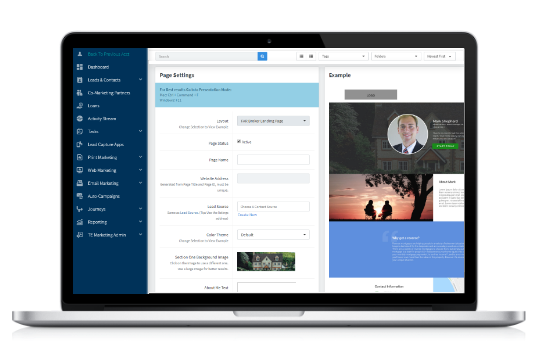

Total Expert Workshop

Total Expert Workshop - 30 minute training on how to use Total Expert Trainer: Ryan Schmidt, Brett Kelly and Meg Murray - Wholesale Marketing Team To register for the class

***Friday Highlights

This is a recording from a previous call that you can view at your leisure. ***Marketing and Ethics Passcode: 9c0%n7u$ Link works best in Chrome and best to manually

*Featured Class Product Options

As you will see, the Home Equity Conversion Morrgagfe or HECM contains various rate structures, payouts and specific uses. there is Traditional HECM, HECM to HECM Refinance, HECM for Purchase

In-House Processing

FAR is pleased to offer our valued partners the option of In-House Processing. We are offering this service (for a nominal fee) as an additional tool to enable our partners

Financial Safeguards for Reverse Mortgage Borrowers

Strategies for recognizing fraud and keeping Older Adults safe from financial predators and abuse. Trainer: Lorraine Geraci, VP of Learning and Development Click here to register Remember the class will

Grass Roots Marketing – Reboot

This course is designed to help Reverse Mortgage Professionals market to Business to Business, Business to Consumer and Business to Communities with a twist of doing this virtually. Trainer: Susan