Introduction to FAU

FAR's Learning System Administrator will introduce you to Finance of America University (FAU), your go-to destination for reverse mortgage training. We'll cover all the basics like course registration, navigating the

Life Expectancy Set-Aside (LESA)

What exactly is a LESA? This is a great class to learn exactly how a LESA is calculated to better explain to your borrowers. Trainer: Sue Haviland, National Sales Trainer

Financial Assessment, Willingness and Capacity, CRMP Approved

Looking at a RM borrower qualification through the Financial Assessment lens. A review of the different credit scenarios of the Reverse Mortgage Borrower. Includes willingness and capacity, liabilities, property charges,

Increase Sales with the Reverse Illustrator

Our powerful Reverse Illustrator will help drive sales to your planning based prospects as it graphically displays the features and flexibility of the reverse mortgage over a 30 year term.

Preparing for the Rebound, CFP CE approved

Free Webinar: An impactful study published in the Journal of Financial Planning has led to a new sequence of returns withdrawal strategy that will help preserve and grow your client’s

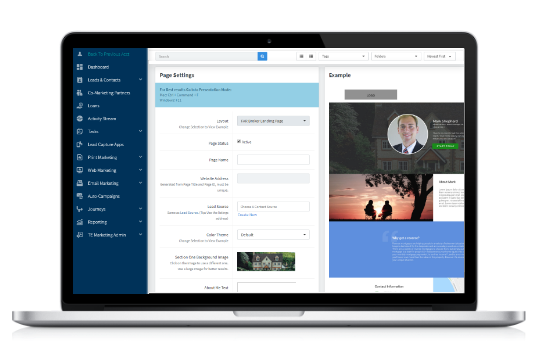

Total Expert Workshop

Total Expert Workshop - 30 minute training on how to use Total Expert Trainer: Ryan Schmidt, Brett Kelly and Meg Murray - Wholesale Marketing Team To register for the class

***Friday Highlights

This is a recording from a previous call that you can view at your leisure. ***Reverse Facts Passcode: fCfB#4es Link works best in Chrome and best to manually input

Funds to Close

If you have to bring funds to closing what are acceptable funds? Trainer: Jessica Rankins, FAR's AVP Training and Process Management To register for the class please click here. Remember

Ask the Trainer!

The trainers will go over any product related questions sent ahead of time. When registering you will be prompted to ask your questions. We will not be able to go

Financial Assessment Tips

Looking at a RM borrower qualification through the Financial Assessment lens. A review of the different credit scenarios of the Reverse Mortgage Borrower. Includes willingness and capacity, liabilities, property charges,

What Advisors Should Know When Their Client Wants to Rightsize

Home equity is a large part of a client's overall net worth. Advisors can add value by guiding clients in a way that benefits their overall retirement plan. In this

Total Expert Workshop

Total Expert Workshop - 30 minute training on how to use Total Expert Trainer: Ryan Schmidt, Brett Kelly and Meg Murray - Wholesale Marketing Team To register for the class