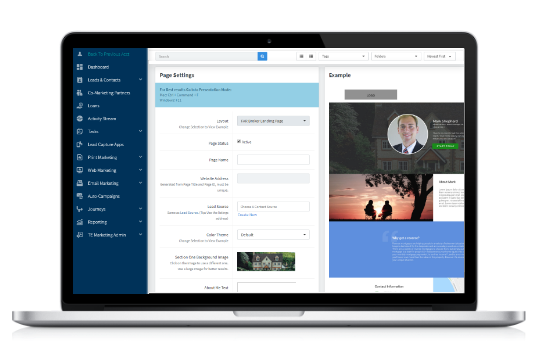

Total Expert Workshop

Total Expert Workshop - 30 minute training on how to use Total Expert Trainer: Ryan Schmidt, Brett Kelly and Meg Murray - Wholesale Marketing Team To register for the class

***Friday Highlights

This is a recording from a previous call that you can view at your leisure. ***HECM to HECM Refinance Passcode: &Ha8o38S Link works best in Chrome and best to

L&D Annual Conference

Learning and Development will be meeting from the 6th to the 8th to discuss 2022.

L&D Annual Conference

Learning and Development will be meeting from the 6th to the 8th to discuss 2022.

Reverse Illustrator and Financial Planning

With rapidly appreciating home values, more and more Financial Advisors and their clients are taking a fresh look at Reverse Mortgages. Now with our powerful Illustrator tool, you will be

L&D Annual Conference

Learning and Development will be meeting from the 6th to the 8th to discuss 2022.

What Advisors Should Know When a Client wants to Rightsize, CFP CE

Home equity is a large part of a client's overall net worth. Advisors can add value by guiding clients in a way that benefits their overall retirement plan. In this

Total Expert Workshop

Total Expert Workshop - 30 minute training on how to use Total Expert Trainer: Ryan Schmidt, Brett Kelly and Meg Murray - Wholesale Marketing Team To register for the class

***Friday Highlights

This is a recording from a previous call that you can view at your leisure. ***Insights into Understanding Our Aging Population Passcode: d4vWyqD+ Link works best in Chrome and

B2B Relationship Building for Loan Officers

This free webinar will cover the distinct difference between B2B and B2C marketing of reverse mortgages. How to build your B2B marketing plan, and how to simply integrate that plan

EquityAvail for Sales

FAR is excited about our new Proprietary Product, EquityAvail. Please join us on this call to learn how the program works, where to access information and some scenarios. Trainer: Susan

Financial Assessment Tips

Looking at a RM borrower qualification through the Financial Assessment lens. A review of the different credit scenarios of the Reverse Mortgage Borrower. Includes willingness and capacity, liabilities, property charges,