***Friday Highlights

This is a recording from a previous call that you can view at your leisure. ***Life Expectancy Set Aside Passcode: ?Tgs1DJE Link works best in Chrome and best to manually input the passcode.

FAR Offices Closed in Observance of Independence Day!

FAR offices will be closed today in observance of the 4th of July.

Funds to Close

If you have to bring funds to closing what are acceptable funds? Trainer: Jessica Rankins, FAR's AVP Training and Process Management To register for the class please click here. Remember the class will be held at 2:30 pm, EST (11:30 am, PDT) HOW to Join the Webinar REGISTRATION: Once you register, you will immediately get

Financial Assessment Tips

Looking at a RM borrower qualification through the Financial Assessment lens. A review of the different credit scenarios of the Reverse Mortgage Borrower. Includes willingness and capacity, liabilities, property charges, extenuating circumstances and LESA. Trainer: Jessica Rankins, AVP of Training and Process Management To register for the class please click here. Remember the class will

Preparing for the Rebound, CFP CE Approved

Free Webinar: An impactful study published in the Journal of Financial Planning has led to a new sequence of returns withdrawal strategy that will help preserve and grow your client’s retirement assets…even if they are taking systematic income distributions. Offering 2 CE Credits for CFPs (for financial professionals only) Duration: 1 hour Trainer: Phil Walker,

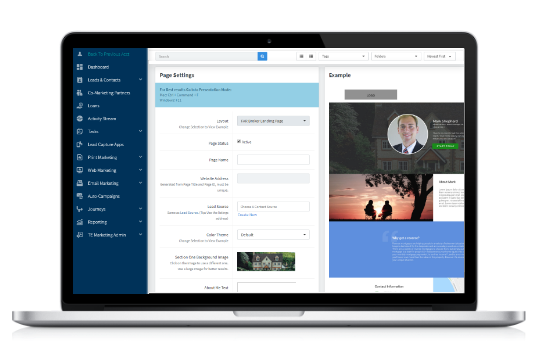

Total Expert Workshop

Total Expert Workshop - 30 minute training on how to use Total Expert Trainer: Ryan Schmidt, Brett Kelly and Meg Murray - Wholesale Marketing Team To register for the class please click here. Remember the class will be held at 3 pm, EST (12 pm, PST) HOW to Join the Webinar REGISTRATION: Once you register,

***Friday Highlights

This is a recording from a previous call that you can view at your leisure. ***Introduction to FAU Passcode: x0lsg.5W Link works best in Chrome and best to manually input the passcode.

ReverseVision Overview

Join us as we discuss and demonstrate how to use ReverseVision to print out both proposals and application. This class will go over Financial Assessment as well. Trainer: Sue Haviland, FAR, National Sales Trainer Click here to register Remember the class will be held at 12:30 pm, EST (9:30 am, PDT) HOW to Join the

Product Options

As you will see, the Home Equity Conversion Mortgage or HECM contains various rate structures, payouts and specific uses. there is Traditional HECM, HECM to HECM Refinance, HECM for Purchase and HomeSafe Standard and Select. Trainer: Sue Haviland, National Sales Trainer To register for the class please click here. Remember the class will be held

Unlock Purchasing Power – In Reverse (A Guide for LO’s)

Market research indicates that between 2018-2030, 20% of all homes purchased will be built or bought by people 55 and older. Learn how you can position yourself to be a trusted adviser by servicing your realtor referral partners with the knowledge of the H4P product. The use of this powerful product can expand their earning

Submitting Conditions

In this presentation we will discover useful tips to help get whatever conditions need addressing cleared as quickly as possible, with the goal to clear the conditions first time the underwriter reviews them. Jessica Rankins will be discussing how to submit conditions correctly. Trainer: Jessica Rankins, FAR's AVP Training and Process Management To register for

What Advisors Should Know When a Client Rightsizes

Home equity is a large part of a client's overall net worth. Advisors can add value by guiding clients in a way that benefits their overall retirement plan. In this 1 hour webinar you will learn: • How a move can be an opportunity to improve retirement plan outcomes • The Downsize and Rightsize Strategy