What Advisors Should Know When a Client Rightsizes

Home equity is a large part of a client's overall net worth. Advisors can add value by guiding clients in a way that benefits their overall retirement plan. In this

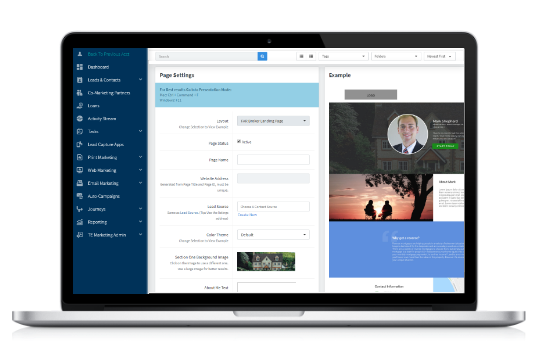

Total Expert Workshop

Total Expert Workshop - 30 minute training on how to use Total Expert Trainer: Ryan Schmidt, Brett Kelly and Meg Murray - Wholesale Marketing Team To register for the class

***Friday Highlights

This is a recording from a previous call that you can view at your leisure. ***Link Training Passcode: ?@0Dgd#z Link works best in Chrome and best to manually input

Submitting a Clean Loan

Learn how to submit a clean loan from the start to prevent conditions. Trainer: Jessica Rankins, FAR's AVP Training and Process Management To register for the class please click here.

Using the Reverse Illustrator with Financial Advisors

Our powerful Reverse Illustrator will help drive sales to your planning based prospects as it graphically displays the features and flexibility of the reverse mortgage over a 30 year term.

Cancelled: Grass Roots Marketing – Reboot

Cancelled due to a conflict with the Instructors schedule. This course is designed to help Reverse Mortgage Professionals market to Business to Business, Business to Consumer and Business to Communities

Funding Long Term Care with Home Equity

Learn how millions of Americans will unintentionally spend 100% of their home equity on care, new strategies for funding Long-Term Care and how a reverse mortgage can help clients age

Total Expert Workshop

Total Expert Workshop - 30 minute training on how to use Total Expert Trainer: Ryan Schmidt, Brett Kelly and Meg Murray - Wholesale Marketing Team To register for the class

***Friday Highlights

This is a recording from a previous call that you can view at your leisure. ***HomeSafe Overview Passcode: 2Z6X13p= Link works best in Chrome and best to manually input

Financial Assessment – Willingness and Capacity, CRMP approved

Looking at a RM borrower qualification through the Financial Assessment lens. A review of the different credit scenarios of the Reverse Mortgage Borrower. Includes willingness and capacity, liabilities, property charges,

EquityAvail for Sales

FAR is excited about our new Proprietary Product, EquityAvail. Please join us on this call to learn how the program works, where to access information and some scenarios. Trainer: Susan

***Featured Class: HECM to HECM Refinance

See how a HECM to HECM might increase your business potential. Learn how to calculate the numbers to determine the benefit to the borrower, whether or not counseling can be