Financial Safeguards for Older Adults, CRMP Approved

Strategies for recognizing fraud and keeping Older Adults safe from financial predators and abuse. Trainer: Lorraine Geraci, VP of Learning and Development Click here to register Remember the class will

Conditions Processing

When FAR's Underwriting dept finds deficiencies in the documentation they receive to clear a condition, the process is delayed while they waif for acceptable documentation. W have some useful tips

Insights into Understanding Our Aging Population, CRMP Approved

Join us to learn about the Reverse Mortgage industry facts, demographics, statistics and information to make you more effective in your market. This is a CRMP approved course and you

ReverseVision Demo

Join us as we discuss and demonstrate how to use ReverseVision to print out both proposals and application. This class will go over Financial Assessment as well. Trainer: Sue Haviland,

What Advisors Should Know When a Client wants to Rightsize

Home equity is a large part of a client's overall net worth. Advisors can add value by guiding clients in a way that benefits their overall retirement plan. In this

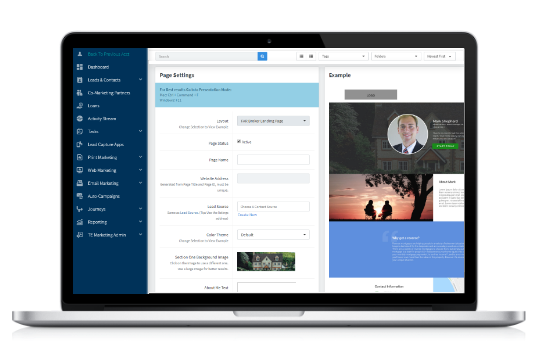

Total Expert Workshop

Total Expert Workshop - 30 minute training on how to use Total Expert Trainer: Ryan Schmidt, Brett Kelly and Meg Murray - Wholesale Marketing Team To register for the class

***Friday Highlights

This is a recording from a previous call that you can view at your leisure. ***HomeSafe Overview Passcode: Hi0Tm=*# Link works best in Chrome and best to manually input

Intent and Creation of the HECM, CRMP Approved

From its first inception to today, has the intent of the HECM Program stayed on course? Explore the history of the original HEM< and what changes have been implemented through

B2B Relationship Building for Loan Officers

This free webinar will cover the distinct difference between B2B and B2C marketing of reverse mortgages. How to build your B2B marketing plan, and how to simply integrate that plan

Using the Reverse Illustrator with Financial Advisors

Our powerful Reverse Illustrator will help drive sales to your planning based prospects as it graphically displays the features and flexibility of the reverse mortgage over a 30 year term.

Financial Assessment – Extenuating Circumstances, CRMP Approved

What happens when a borrower's credit history does not meet the HUDS's Financial Assessment criteria? Can the lender consider any extenuating circumstances that le to the issues? Trainer: Susan Haviland,

Funding Long Term Care with Home Equity

Learn how millions of Americans will unintentionally spend 100% of their home equity on care, new strategies for funding Long-Term Care and how a reverse mortgage can help clients age