Grass Roots Marketing: Reboot

This course is designed to help Reverse Mortgage Professionals market to Business to Business, Business to Consumer and Business to Communities with a twist of doing this virtually. Trainer: Susan Haviland, National Sales Trainer To register for the class please click here. Remember the class will be held at 1 pm, EDT (10 am, PDT)

What Sales Should Know About Servicing, CRMP approved

Learn what Servicing does after a loan closes. Trainer: Barbara Cripple, Retail Sales Trainer and Sue Haviland, National Sales Trainer To register for the class please click here. Remember the class will be held at 12 pm, EST (9am, PDT) HOW to Join the Webinar REGISTRATION: Once you register, you will immediately get a confirmation

Product Options

As you will see, the Home Equity Conversion Mortgage or HECM contains various rate structures, payouts and specific uses. there is Traditional HECM, HECM to HECM Refinance, HECM for Purchase and HomeSafe Standard and Select. Trainer: Sue Haviland, National Sales Trainer To register for the class please click here. Remember the class will be held

Using Reverse Illustrator with Financial Advisors

Our powerful Reverse Illustrator will help drive sales to your planning based prospects as it graphically displays the features and flexibility of the reverse mortgage over a 30 year term. The Illustrator combines interactive charts and graphs to answer a number of “What if” questions. Duration: 1 hour Trainer: Steve Resch, FAR - VP of

Financial Assessment Tips

Looking at a RM borrower qualification through the Financial Assessment lens. A review of the different credit scenarios of the Reverse Mortgage Borrower. Includes willingness and capacity, liabilities, property charges, extenuating circumstances and LESA. Trainer: Jessica Rankins, AVP of Training and Process Management To register for the class please click here. Remember the class will

What Advisors Should Know When a Client Wants to Rightsize

Home equity is a large part of a client's overall net worth. Advisors can add value by guiding clients in a way that benefits their overall retirement plan. In this 1 hour webinar you will learn: • How a move can be an opportunity to improve retirement plan outcomes • The Downsize and Rightsize Strategy

Introduction to Reverse for Purchase

The Home Equity Conversion Mortgage (HECM), also known as a reverse mortgage, is a federally insured home loan that allows adult homeowners, aged 62 and older, to convert a percentage of their home equity into cash or a line of credit (LOC) Trainer: Sue Haviland, National Sales Trainer To register for the class please click

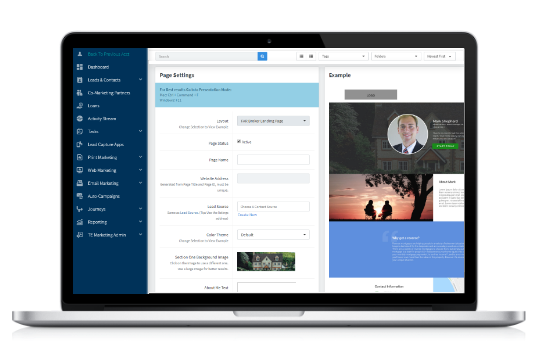

Total Expert Workshop

Total Expert Workshop - 30 minute training on how to use Total Expert Trainer: Ryan Schmidt, Brett Kelly and Meg Murray - Wholesale Marketing Team To register for the class please click here. Remember the class will be held at 3 pm, EST (12 pm, PST) HOW to Join the Webinar REGISTRATION: Once you register,

***Friday Highlights

This is a recording from a previous call that you can view at your leisure. ***Financial Assessment Tips Passcode: nA3&#@zU Link works best in Chrome and best to manually input the passcode.

Featured Class: Silver Divorce

Using home equity for clients over 60 during the "Silver Divorce", a guide for divorce attorneys. Trainer: Sue Haviland, National Wholesales Trainer To register for the class please click here. Remember the class will be held at 1pm, EST (10am, PDT) HOW to Join the Webinar REGISTRATION: Once you register, you will immediately get a

EquityAvail for Sales

FAR is excited about our new Proprietary Product, EquityAvail. Please join us on this call to learn how the program works, where to access information and some scenarios. Trainer: Susan Haviland, National Sales Trainer and Barbara Cripple, Retail Sales Trainer To register for the class please click here. Remember the class will be held at

Broker Compensation

If you are wondering what sort of questions to ask your clients in order to put them in the proper loan product this is the webinar for you. We will be showing you how to structure a loan in Link dependent on the client's needs. Trainer: Sue Haviland, National Wholesale Trainer To register for the