Reverse Facts, CRMP Approved

Join us to learn about the Reverse Mortgage industry facts, demographics, statistics and information to make you more effective in your market. This is a CRMP approved course and you can earn 1 CRMP CE credit. Trainer: Susan Haviland, National Sales Trainer and Barbara Cripple, Retail Sales Trainer To register for the class please click here.

Introduction to Reverse

Whether you are new to the industry or want to brush up on your RM skills this call is for you. We will be discussing: What is a Reverse Mortgage?, Historical Perspective and The Borrower. Trainer: Sue Haviland, National Sales Trainer To register for the class please click here. Remember the class will be held

Preparing for the Rebound, CE Approved

Free Webinar: An impactful study published in the Journal of Financial Planning has led to a new sequence of returns withdrawal strategy that will help preserve and grow your client’s retirement assets…even if they are taking systematic income distributions. Offering 2 CE Credits for CFPs (for financial professionals only) Duration: 1 hour Trainer: Phil Walker,

Total Expert Workshop

Total Expert Workshop - 30 minute training on how to use Total Expert Trainer: Ryan Schmidt, Brett Kelly and Meg Murray - Wholesale Marketing Team To register for the class please click here. Remember the class will be held at 3 pm, EST (12 pm, PST) HOW to Join the Webinar REGISTRATION: Once you register,

***Friday Highlight

This is a recording from a previous call that you can view at your leisure. ***EquityAvail for Sales Passcode: @bB.8qVP Link works best in Chrome and best to manually input the passcode.

Marketing and Ethics, CRMP approved

Choose your words wisely! Finding the balance between responsible wording in your marketing efforts and obtaining results that sustain your business can be a challenge. Familiarize yourself with your ethical responsibilities to the industry and its customer base, and insight into proper marketing tactics and messaging. Trainer: Barb Cripple, Retail Sales Trainer and Sue Haviland,

Manage Post-Retirement Risk in Housing Wealth

Post-Retirement Risk is a potential risk to financial security that an individual may encounter after they retire. In this class we will look at how home equity, accessed with a reverse mortgage, can provide income-tax free liquidity, options, and flexibility to manage those risks. We will explain how the product works including eligibility, costs, misconceptions,

Increase Sales with the Reverse Illustrator

Our powerful Reverse Illustrator will help drive sales to your planning based prospects as it graphically displays the features and flexibility of the reverse mortgage over a 30 year term. The Illustrator combines interactive charts and graphs to answer a number of “What if” questions. Duration: 1 hour Trainer: Steve Resch, FAR - VP of

What Advisors Should Know When Their Client Wants to Rightsize

Home equity is a large part of a client's overall net worth. Advisors can add value by guiding clients in a way that benefits their overall retirement plan. In this 1 hour webinar you will learn: • How a move can be an opportunity to improve retirement plan outcomes • The Downsize and Rightsize Strategy

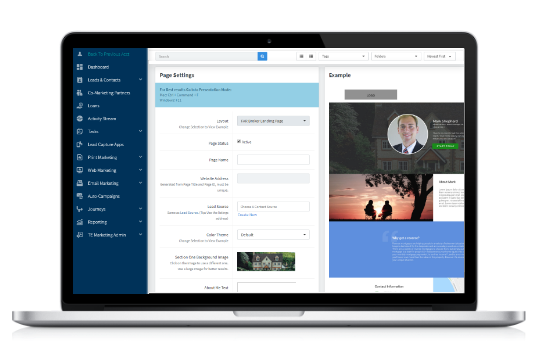

Total Expert Workshop

Total Expert Workshop - 30 minute training on how to use Total Expert Trainer: Ryan Schmidt, Brett Kelly and Meg Murray - Wholesale Marketing Team To register for the class please click here. Remember the class will be held at 3 pm, EST (12 pm, PST) HOW to Join the Webinar REGISTRATION: Once you register,

***Friday Highlights

This is a recording from a previous call that you can view at your leisure. ***Conditions Processing Passcode: KyW3SC8% Link works best in Chrome and best to manually input the passcode.

Life of Loan Overview

Have you ever wondered what happens during the loan process? What happens when the loan closes? What does the Servicer actually do? How does the loan get shipped to HUD? This is the class for you. Trainer: Jessica Rankins, AVP of Training and Process Management To register for the class please click here. Remember the