***Friday Highlights

This is a recording from a previous call that you can view at your leisure. ***Reverse for Purchase Passcode: J+$uvQ8# Link works best in Chrome and best to manually input the passcode. This is a CRMP approved course but in order to earn credit you must take the course live or on FAU

Financial Safeguards for Older Adults, CRMP Approved

Strategies for recognizing fraud and keeping Older Adults safe from financial predators and abuse. Trainer: Lorraine Geraci, VP of Learning and Development Click here to register Remember the class will be held at 1 pm, EST (10am, PDT) HOW to Join the Webinar REGISTRATION: Once you register, you will immediately get a confirmation email that

Conditions Processing

When FAR's Underwriting dept finds deficiencies in the documentation they receive to clear a condition, the process is delayed while they waif for acceptable documentation. W have some useful tips to address these in order to help get your conditions cleared as quickly as possible, with the goal to clear the conditions the first time

Insights into Understanding Our Aging Population, CRMP Approved

Join us to learn about the Reverse Mortgage industry facts, demographics, statistics and information to make you more effective in your market. This is a CRMP approved course and you can earn 1 CRMP CE credit. Trainer: Susan Haviland, National Sales Trainer and Barbara Cripple, Retail Sales Trainer To register for the class please click here.

ReverseVision Demo

Join us as we discuss and demonstrate how to use ReverseVision to print out both proposals and application. This class will go over Financial Assessment as well. Trainer: Sue Haviland, FAR, National Sales Trainer Click here to register Remember the class will be held at 2 pm, EST (11 am, PDT) HOW to Join the

What Advisors Should Know When a Client wants to Rightsize

Home equity is a large part of a client's overall net worth. Advisors can add value by guiding clients in a way that benefits their overall retirement plan. In this 1 hour webinar you will learn: • How a move can be an opportunity to improve retirement plan outcomes • The Downsize and Rightsize Strategy

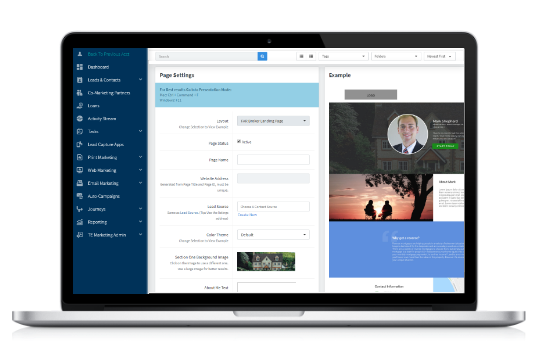

Total Expert Workshop

Total Expert Workshop - 30 minute training on how to use Total Expert Trainer: Ryan Schmidt, Brett Kelly and Meg Murray - Wholesale Marketing Team To register for the class please Click here to register Remember the class will be held at 3 pm, EST (12 pm, PST) HOW to Join the Webinar REGISTRATION:

***Friday Highlights

This is a recording from a previous call that you can view at your leisure. ***HomeSafe Overview Passcode: Hi0Tm=*# Link works best in Chrome and best to manually input the passcode.

Intent and Creation of the HECM, CRMP Approved

From its first inception to today, has the intent of the HECM Program stayed on course? Explore the history of the original HEM< and what changes have been implemented through the years to insure safeguards and protections for the benefit of the borrower, and requirements of the borrower to insure the longevity and integrity of

B2B Relationship Building for Loan Officers

This free webinar will cover the distinct difference between B2B and B2C marketing of reverse mortgages. How to build your B2B marketing plan, and how to simply integrate that plan into your existing schedule. Trainer: Phil Walker, FAR - Retirement Strategies To register for the class please click here. Remember the class will be held at

Using the Reverse Illustrator with Financial Advisors

Our powerful Reverse Illustrator will help drive sales to your planning based prospects as it graphically displays the features and flexibility of the reverse mortgage over a 30 year term. The Illustrator combines interactive charts and graphs to answer a number of “What if” questions. Duration: 1 hour Trainer: Steve Resch, FAR - VP of

Financial Assessment – Extenuating Circumstances, CRMP Approved

What happens when a borrower's credit history does not meet the HUDS's Financial Assessment criteria? Can the lender consider any extenuating circumstances that le to the issues? Trainer: Susan Haviland, National Sales Trainer and Barb Cripple, Retail Sales Trainer To register for the class please click here. Remember the class will be held at 1