Back to Basics: Building Rapport with your Prospect

Building Rapport is the first step of the Discovery phase when interacting with a potential prospect. Trainer: Jim McMinn, FAR - Lead Sales Trainer and Marci Stevenson, RCC Lead Trainer To register for the class please click here. Remember the class will be held at 3:30 pm, EDT (12:30 pm, PDT) HOW to Join the

Funding Long Term Care with Home Equity

Learn how millions of Americans will unintentionally spend 100% of their home equity on care, new strategies for funding Long-Term Care and how a reverse mortgage can help clients age in place and prevent portfolio liquidation. Trainer: Phil Walker, FAR - Retirement Strategies To register for the class please click here. Remember the class will be

***Friday Highlights

Listen to some recorded webinars to brush up on your Reverse Mortgage skills! These are links to recordings. If you cannot open the links in Internet Explorer try Chrome. ***Submitting Conditions Password: 5L?67ee4

HECM Math Part 1

This is a 2 part training that will explore some basic and advanced HECM calculations. Keep in mind, your loan origination system will automatically perform these calculations however learning how these calculations work will help you better understand the HECM product. In this section we will talk about the Basic calculations Trainer: Jim McMinn, FAR's

HECM Math Part 2

This is a 2 part training that will explore some basic and advanced HECM calculations. Keep in mind, your loan origination system will automatically perform these calculations however learning how these calculations work will help you better understand the HECM product. In this section we will talk about the Advanced calculations In this section we

***Recording

***Financial Safeguards for Older Adults Password: 8Z!4i3$c In order to receive CRMP credit you must attend a live class or take the class on FAU

Grass Roots Marketing: Phase 2

This course is designed to help Reverse Mortgage Professionals market to Business to Business, Business to Consumer and Business to Communities with a twist of doing this virtually. Trainer: Lorraine Geraci, VP of Learning and Development To register for the class please click here. Remember the class will be held at 3 pm, EDT (12

Back to Basics: Going 3 Deep with Questions

The importance of asking questions in selling is unquestionable, the deeper you get the more valuable the knowledge and the greater your selling advantage. Trainer: Jim McMinn, FAR - Lead Sales Trainer and Marci Stevenson, RCC Lead Trainer To register for the class please click here. Remember the class will be held at 1:30 pm,

***Friday Highlights

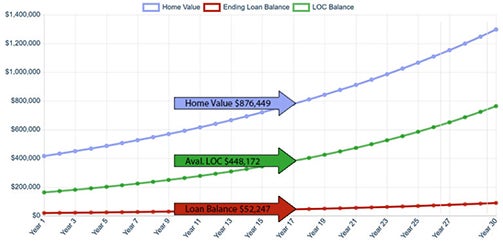

Listen to some recorded webinars to brush up on your Reverse Mortgage skills! These are links to recordings. If you cannot open the links in Internet Explorer try Chrome. ***Line of Credit and how it is Determined Password: 1F=3x28v

***Monday Recap

***HECM and HomeSafe: Practical Product Use Password: 9j@00970

Wholesale Processing

Getting started with FAR in regards to submitting loans through ReverseVision, stacking list, and re-disclosures and submission. Trainer: Jessica Rankins, FAR's AVP Training and Process Management To register for the class please click here. Remember the class will be held at 3 pm, EST (12 pm, PDT) HOW to Join the Webinar REGISTRATION: Once you

HECM Non-Borrowers, CRMP approved

How are Non-Borrowing Spouses and Non-Borrowing Owners treated? What can and can't they do? Trainer: Dan Hultquist, VP of Organizational Development To register for the class please click here. Remember the class will be held at 1:30 pm, EST (10:30 am, PDT) HOW to Join the Webinar REGISTRATION: Once you register, you will immediately get