Using Home Equity for Clients Over 60 During a Divorce

Using home equity for clients over 60 during the "Silver Divorce", a guide for divorce attorneys. Trainer: Sue Haviland, National Wholesales Trainer To register for the class please click here. Remember the class will be held at 2pm, EST (11 am, PDT) HOW to Join the Webinar REGISTRATION: Once you register, you will immediately get

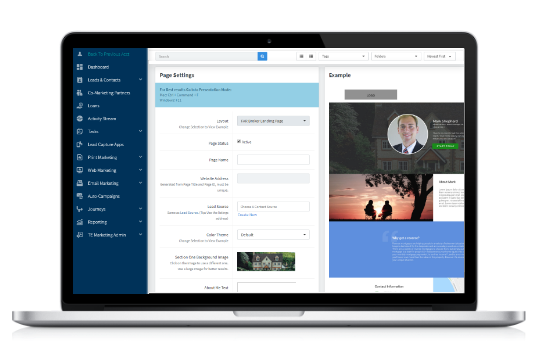

Total Expert Workshop

Total Expert Workshop - 30 minute training on how to use Total Expert Trainer: Ryan Schmidt, Brett Kelly and Meg Murray - Wholesale Marketing Team To register for the class please Click here to register Remember the class will be held at 3 pm, EST (12 pm, PST) HOW to Join the Webinar REGISTRATION:

***Friday Highlights

This is a recording from a previous call that you can view at your leisure. ***What Sales Should Know About Servicing Passcode: U^j&NQ=0 Link works best in Chrome and best to manually input the passcode. This is a CRMP approved course but in order to earn credit you must take the course live or

HECM Non-Borrowing Spouse

The basics of the Non-Borrowing Spouse guidelines as well as some HomeSafe® NBS policies Trainer: Jessica Rankins, AVP of Training and Process Management To register for the class please click here. Remember the class will be held at 12:30 pm, EST (9:30 am, PDT) HOW to Join the Webinar REGISTRATION: Once you register, you will

ReverseVision Demonstration

Join us as we discuss and demonstrate how to use ReverseVision to print out both proposals and application. This class will go over Financial Assessment as well. Trainer: Sue Haviland, FAR, National Sales Trainer Click here to register Remember the class will be held at 2 pm, EST (11 am, PDT) HOW to Join the

In Home Care

This class is a guide to partnering with Home Care Agencies using grass roots marketing efforts. Trainer: Susan Haviland, National Wholesale Sales Trainer To register for the class please Click here to register Remember the class will be held at 1 pm, EST (10 pm, PST) HOW to Join the Webinar REGISTRATION: Once you

HECM to HECM Refinance

See how a HECM to HECM might increase your business potential. Learn how to calculate the numbers to determine the benefit to the borrower, whether or not counseling can be waived, and when to locate key refinance information. Trainer: Jessica Rankins, AVP of Training and Process Management To register for the class please click here.

Total Expert Workshop

Total Expert Workshop - 30 minute training on how to use Total Expert Trainer: Ryan Schmidt, Brett Kelly and Meg Murray - Wholesale Marketing Team To register for the class please Click here to register Remember the class will be held at 3 pm, EST (12 pm, PST) HOW to Join the Webinar REGISTRATION:

***Friday Highlights

This is a recording from a previous call that you can view at your leisure. ***Marketing and Ethics Passcode: =ri683LD Link works best in Chrome and best to manually input the passcode. This is a CRMP approved course but in order to earn credit you must take the course live or on FAU

**Recording

This is a recording from a previous call that you can view at your leisure. **Product Options Password: 3S+tm*V!

**Recording

This is a recording from a previous call that you can view at your leisure. **HECM Math 1: The Basics Password: L%d7GS5C

Financial Assessment Tips

Looking at a RM borrower qualification through the Financial Assessment lens. A review of the different credit scenarios of the Reverse Mortgage Borrower. Includes willingness and capacity, liabilities, property charges, extenuating circumstances and LESA. Trainer: Jessica Rankins, AVP of Training and Process Management To register for the class please click here. Remember the class will