Financial Assessment Tips

Looking at a RM borrower qualification through the Financial Assessment lens. A review of the different credit scenarios of the Reverse Mortgage Borrower. Includes willingness and capacity, liabilities, property charges,

Reverse Illustrator

Our powerful Reverse Illustrator will help drive sales to your planning based prospects as it graphically displays the features and flexibility of the reverse mortgage over a 30 year term.

***Friday Highlight

This is a recording from a previous call that you can view at your leisure. ***Wholesale Conditions Processing Password: ##7NXNVh Link works best in Chrome and best to manually input

Life of Loan Overview

Have you ever wondered what happens during the loan process? What happens when the loan closes? What does the Servicer actually do? How does the loan get shipped to HUD?

Submitting a Clean Loan

Learn how to submit a clean loan from the start to prevent conditions. Trainer: Jessica Rankins, FAR's AVP Training and Process Management and Sue Haviland, National Sales Trainer To register

Introduction to Reverse

Whether you are new to the industry or want to brush up on your RM skills this call is for you. We will be discussing: What is a Reverse Mortgage?,

Preparing for the Rebound, CFP CE Approved

Free Webinar: An impactful study published in the Journal of Financial Planning has led to a new sequence of returns withdrawal strategy that will help preserve and grow your client’s

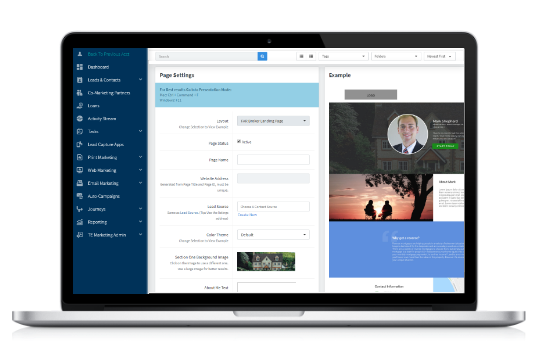

Total Expert Workshop

Total Expert Workshop - 30 minute training on how to use Total Expert Trainer: Ryan Schmidt, Brett Kelly and Meg Murray - Wholesale Marketing Team To register for the class

***Friday Highlights

This is a recording from a previous call that you can view at your leisure. ***Financial Safeguards for Older Adults Passcode: ^F4PTh%H This is a CRMP approved course but to

Conditions Processing

When FAR's Underwriting dept finds deficiencies in the documentation they receive to clear a condition, the process is delayed while they waif for acceptable documentation. W have some useful tips

Intent and Creation of the HECM, CRMP approved

From its first inception to today, has the intent of the HECM Program stayed on course? Explore the history of the original HEM< and what changes have been implemented through

What Advisors Should Know When a Client wants to Righsize Their Home

Home equity is a large part of a client's overall net worth. Advisors can add value by guiding clients in a way that benefits their overall retirement plan. In this