Calendar of Events

M Mon

T Tue

W Wed

T Thu

F Fri

S Sat

S Sun

2 events,

Introduction to Reverse

Introduction to Reverse

The Home Equity Conversion Mortgage (HECM), also known as a reverse mortgage, is a federally insured home loan that allows adult homeowners, aged 62 and older, to convert a percentage of their home equity into cash or a line of credit (LOC) Trainer: Sue Haviland, National Wholesale Trainer To register for the class please click

In-House Processing

In-House Processing

Learn how to free up time and streamline success by offloading time-expensive loan processing to our in-house specialists. Trainer: Jessica Rankins, FAR's AVP Training and Process Management To register for the class please click here. Remember the class will be held at 11am, EST (8 am, PDT) HOW to Join the Webinar REGISTRATION: Once you

1 event,

ReverseVision (Origination) Live Demo

ReverseVision (Origination) Live Demo

Learn how to successfully meet all seasoning and occupancy requirements for reverse mortgage borrowers, a key documentation process that underwriters review on the path to loan approval Trainer: Sue Haviland, FAR, National Sales Trainer Click here to register Remember the class will be held at 12:30 pm, EST (9:30 am, PDT) HOW to Join the

2 events,

Broker Compensation

Broker Compensation

Learn how to structure your loan to maximize your compensation along with reading a pricing sheet. Trainer: Sue Haviland, National Wholesale Trainer To register for the class please click here. Remember the class will be held at 1 pm, EST (10 am, PST) HOW to Join the Webinar REGISTRATION: Once you register, you will immediately

Title Commitments

Title Commitments

This class is a closer look at the title commitment, what it entails and what is required Trainer: Jessica Rankins, FAR's AVP Training and Process Management To register for the class please click here. Remember the class will be held at 3 pm, EST (12 pm, PDT) HOW to Join the Webinar REGISTRATION: Once you

1 event,

On Demand: Wholesale Processing

This is a recording from a previous call on: ***Wholesale Processing Passcode not required The link works best in Chrome

1 event,

*Friday Highlights and What’s Happening Next?

Thank you for spending some time with us this week. Take a look at FAR's featured recording that you can access on demand. HomeSafe® Select No password required Take a look at next weeks highlighted featured course: Back to Basics: Building a Rapport with your Clients

0 events,

0 events,

1 event,

2 events,

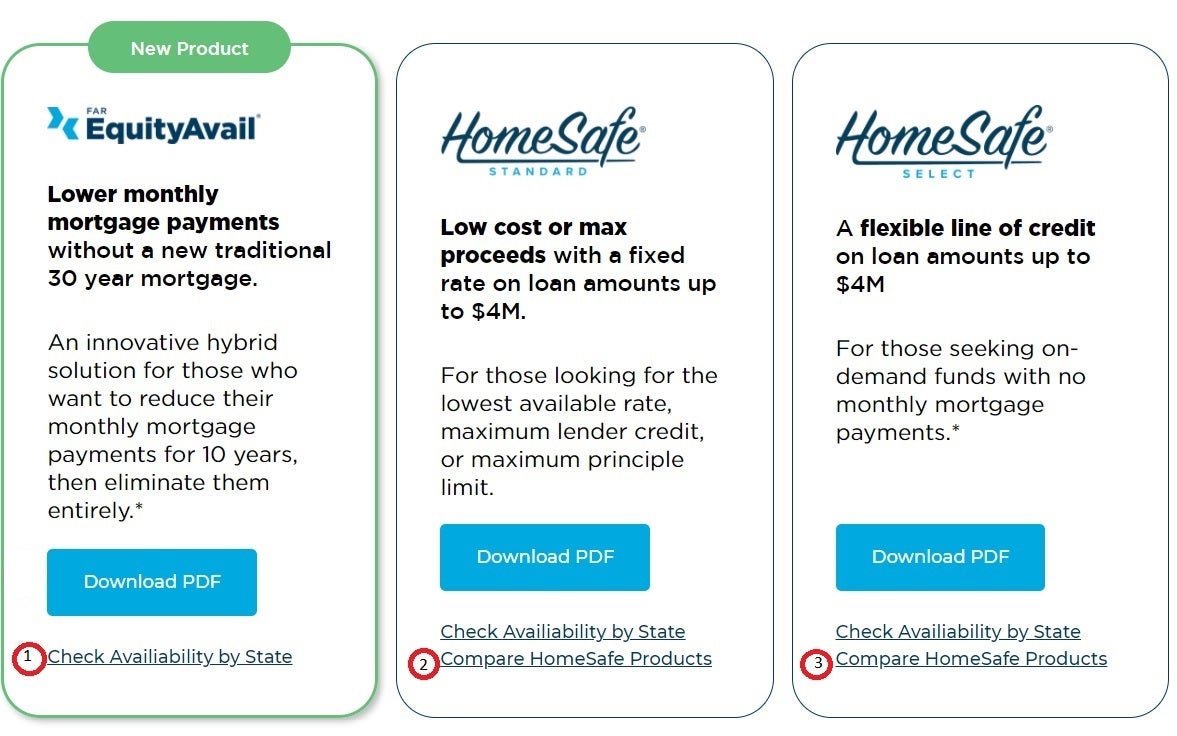

HomeSafe® Overview

HomeSafe® Overview

FAR's proprietary product offers the perfect niche for home values greater than HUD's HECM limits. Trainer: Barb Cripple, Retail Sales Training Manager To register for the class please click here. Remember the class will be held at 12:30 pm, EDT (9:30 am, PDT) HOW to Join the Webinar REGISTRATION: Once you register, you will immediately

Introduction to Reverse

Introduction to Reverse

The Home Equity Conversion Mortgage (HECM), also known as a reverse mortgage, is a federally insured home loan that allows adult homeowners, aged 62 and older, to convert a percentage of their home equity into cash or a line of credit (LOC) Trainer: Jackie Stultz, Jr. Wholesale Trainer To register for the class please click

1 event,

Back to Basics: Building a Rapport with your Clients

Back to Basics: Building a Rapport with your Clients

Building Rapport is the first step of the Discovery phase when interacting with a potential prospect. Trainer: Bo Higby, Retail Sales Training Coach To register for the class please click here. Remember the class will be held at 3 pm, EDT (12 pm, PDT) HOW to Join the Webinar REGISTRATION: Once you register, you will

2 events,

Product Options

Product Options

As you will see, the Home Equity Conversion Mortgage or HECM contains various rate structures, payouts and specific uses. there is Traditional HECM, HECM to HECM Refinance, HECM for Purchase and HomeSafe Standard and Select. Trainer: Jackie Stultz, Jr. Wholesale Trainer To register for the class please click here. Remember the class will be held

Preparing for the Rebound, CFP CE Approved

Preparing for the Rebound, CFP CE Approved

Free Webinar: An impactful study published in the Journal of Financial Planning has led to a new sequence of returns withdrawal strategy that will help preserve and grow your client’s retirement assets…even if they are taking systematic income distributions. Offering 2 CE Credits for CFPs (for financial professionals only) Duration: 1 hour Trainer: Phil Walker,

1 event,

*Friday Highlights and What’s Happening Next?

Thank you for spending some time with us this week. Take a look at FAR's featured recording that you can access on demand. Overcoming Objections No password required Take a look at next weeks highlighted featured course: EquityAvail for Sales

0 events,

0 events,

1 event,

EquityAvail for Sales

EquityAvail for Sales

FAR is excited about our new Proprietary Product, EquityAvail. Please join us on this call to learn how the program works, where to access information and some scenarios. Trainer: Susan Haviland, National Sales Trainer To register for the class please click here. Remember the class will be held at 1 pm, EST (10 am, PST)

1 event,

On Demand: Empathy in Sales

This is a recording from a previous call on: ***Empathy in Sales Passcode not required The link works best in Chrome

1 event,

Broker Compensation

Broker Compensation

Learn how to structure your loan to maximize your compensation along with reading a pricing sheet. Trainer: Sue Haviland, National Wholesale Trainer To register for the class please click here. Remember the class will be held at 2:30 pm, EST (11:30am, PST) HOW to Join the Webinar REGISTRATION: Once you register, you will immediately get

1 event,

What Advisors Should Know When a Client Rightsizes, CFP CE approved

What Advisors Should Know When a Client Rightsizes, CFP CE approved

Home equity is a large part of a client's overall net worth. Advisors can add value by guiding clients in a way that benefits their overall retirement plan. In this 1 hour webinar you will learn: • How a move can be an opportunity to improve retirement plan outcomes • The Downsize and Rightsize Strategy

1 event,

*Friday Highlights and What’s Happening Next?

Thank you for spending some time with us this week. Take a look at FAR's featured recording that you can access on demand. Submitting a Clean Loan No password required Take a look at next weeks highlighted featured course: Introduction to Reverse

0 events,

0 events,

1 event,

ReverseVision Live-Demo: Proposal

ReverseVision Live-Demo: Proposal

Join us as we discuss and demonstrate how to use ReverseVision to print out both proposals. This class will go over Financial Assessment as well. Trainer: Sue Haviland, FAR, National Sales Trainer Click here to register Remember the class will be held at 2 pm, EST (11am, PDT) HOW to Join the Webinar REGISTRATION: Once

3 events,

Introduction to Reverse

Introduction to Reverse

The Home Equity Conversion Mortgage (HECM), also known as a reverse mortgage, is a federally insured home loan that allows adult homeowners, aged 62 and older, to convert a percentage of their home equity into cash or a line of credit (LOC) Trainer: Sue Haviland, National Wholesale Trainer To register for the class please click

HomeSafe® Overview

HomeSafe® Overview

FAR's proprietary product offers the perfect niche for home values greater than HUD's HECM limits. Trainer: Sue Haviland, National Wholesale Sales Trainer To register for the class please click here. Remember the class will be held at 1 pm, EDT (10 am, PDT) HOW to Join the Webinar REGISTRATION: Once you register, you will immediately

Date Change: Reverse Illustrator for Financial Planning Concepts

Date Change: Reverse Illustrator for Financial Planning Concepts

With rapidly appreciating home values, more and more Financial Advisors and their clients are taking a fresh look at Reverse Mortgages. Now with our powerful Illustrator tool, you will be able to show them the flexibility and options that a reverse mortgage can bring to a financial plan. The Illustrator combines interactive charts and graphs

3 events,

HECM for Purchase for Operations

HECM for Purchase for Operations

This class is an overview of HECM for Purchase requirements from an Operations perspective. Trainer: Jessica Rankins, AVP Training and Process Management To register for the class please click here Remember the class will be held at 11am, EST (8 am, PDT) HOW to Join the Webinar REGISTRATION: Once you register, you will immediately get

Planning for Success: Smart Time Management

Planning for Success: Smart Time Management

Purpose of this training is to provide basic time management principles for those involved in lead generation and sales. Time management is a process for developing a plan to manage one’s activities and to track the effectiveness of one’s plan. Utilization of a time management plan can lead to increased production in sales and lead

Funding Long Term Care with Home Equity, CFP CE Approved

Funding Long Term Care with Home Equity, CFP CE Approved

Learn how millions of Americans will unintentionally spend 100% of their home equity on care, new strategies for funding Long-Term Care and how a reverse mortgage can help clients age in place and prevent portfolio liquidation. Trainer: Phil Walker, FAR - Retirement Strategies To register for the class please click here. Remember the class will be

3 events,

Completing a Valid Change Circumstance Worksheet

Completing a Valid Change Circumstance Worksheet

In this course you will learn how when, why on completing a Valid Change of Circumstance Worksheet for Re-Disclosures. Trainer: Jessica Rankins, AVP Training and Process Management To register for the class please click here Remember the class will be held at 11am, EST (8 am, PDT) HOW to Join the Webinar REGISTRATION: Once you

ReverseVision Live Demo: Origination

ReverseVision Live Demo: Origination

Learn how to successfully meet all seasoning and occupancy requirements for reverse mortgage borrowers, a key documentation process that underwriters review on the path to loan approval Trainer: Sue Haviland, FAR, National Sales Trainer Click here to register Remember the class will be held at 1 pm, EST (10 am, PDT) HOW to Join the

Marketing and Ethics, CRMP Approved

Marketing and Ethics, CRMP Approved

Choose your words wisely! Finding the balance between responsible wording in your marketing efforts and obtaining results that sustain your business can be a challenge. Familiarize yourself with your ethical responsibilities to the industry and its customer base, and insight into proper marketing tactics and messaging. Trainer: Sue Haviland, National Sales Trainer To register for

1 event,

*Friday Highlights and What’s Happening Next?

Thank you for spending some time with us this week. Take a look at FAR's featured recording that you can access on demand. HECM to HECM Refinance No password required Take a look at next weeks highlighted featured course: Financial Assessment Overview

0 events,

0 events,

1 event,

HECM Math 1: The Basics

HECM Math 1: The Basics

This is a 2 part training that will explore some basic and advanced HECM calculations. Keep in mind, your loan origination system will automatically perform these calculations however learning how these calculations work will help you better understand the HECM product. In this section we will talk about the Basic calculations Trainer: Jackie Stultz, Jr.

3 events,

Re-Disclosures

Re-Disclosures

In this course we will cover what disclosures are and why they are necessary and when they are required. Trainer: Jessica Rankins, AVP Training and Process Management To register for the class please click here Remember the class will be held at 1pm, EST (10m, PDT) HOW to Join the Webinar REGISTRATION: Once you register,

B2B Training for Loan Officers

B2B Training for Loan Officers

This free webinar will cover the distinct difference between B2B and B2C marketing of reverse mortgages. How to build your B2B marketing plan, and how to simply integrate that plan into your existing schedule. Trainer: Phil Walker, FAR - Retirement Strategies To register for the class please click here. Remember the class will be held at

Can We Talk

Can We Talk

This training is meant to provide a roadmap to great communication regarding Retirement Mortgage Products. This course will cover communication skills, client generational differences and how to get your clients over the finish line with Retirement Mortgage Products. Trainer: Bo Higby, Sales Training Coach To register for the class please click here Remember the class

1 event,

Financial Assessment Overview

Financial Assessment Overview

Looking at a RM borrower qualification through the Financial Assessment lens. A review of the different credit scenarios of the Reverse Mortgage Borrower. Includes willingness and capacity, liabilities, property charges, extenuating circumstances and LESA. Trainer: Sue Haviland, National Wholesale Sales Trainer To register for the class please click here. Remember the class will be held

1 event,

On Demand: Funds to Close

This is a recording from a previous call on: ***Funds to Close Passcode not required The link works best in Chrome

1 event,

*Friday Highlights and What’s Happening Next?

Thank you for spending some time with us this week. Take a look at FAR's featured recording that you can access on demand. Creating Urgency No password required Take a look at next weeks highlighted featured course: Why Reverse? Why FAR? Why Now?

0 events,

0 events,

EquityAvail for Sales